If you love gadgets, you probably upgrade your smartphone, tablet, or wearable more often than the average user.

At the same time, you may have felt frustration with mobile connectivity: waiting for a SIM card to arrive, visiting a carrier store, or struggling to move your number when switching devices.

In Japan, this long‑standing friction is now being fundamentally challenged by the rapid spread of eSIM technology.

An embedded SIM removes the physical card entirely and turns mobile connectivity into a software-driven experience.

This shift is not just about convenience; it is changing how carriers compete, how users switch networks, and how future devices are designed.

Japan is a particularly fascinating case, because eSIM‑ready smartphones have been widespread for years, while user experience and carrier support have lagged behind.

For global gadget fans, understanding this gap offers valuable insight into where mobile connectivity is heading next.

This article explores how eSIM is transforming the Japanese market from multiple angles, including government policy, GSMA technical standards, real‑world switching experiences on iPhone and Android, and emerging trends like IoT and iSIM.

By reading to the end, you will gain a strategic perspective on eSIM that goes far beyond basic setup guides and helps you make smarter choices about devices, carriers, and ecosystems in the years ahead.

- From Physical SIMs to Digital Freedom: Why eSIM Changes Everything

- Japan’s Unique eSIM Landscape and Global Market Position

- Government Policy and Competition: Inside Japan’s Switching Facilitation Efforts

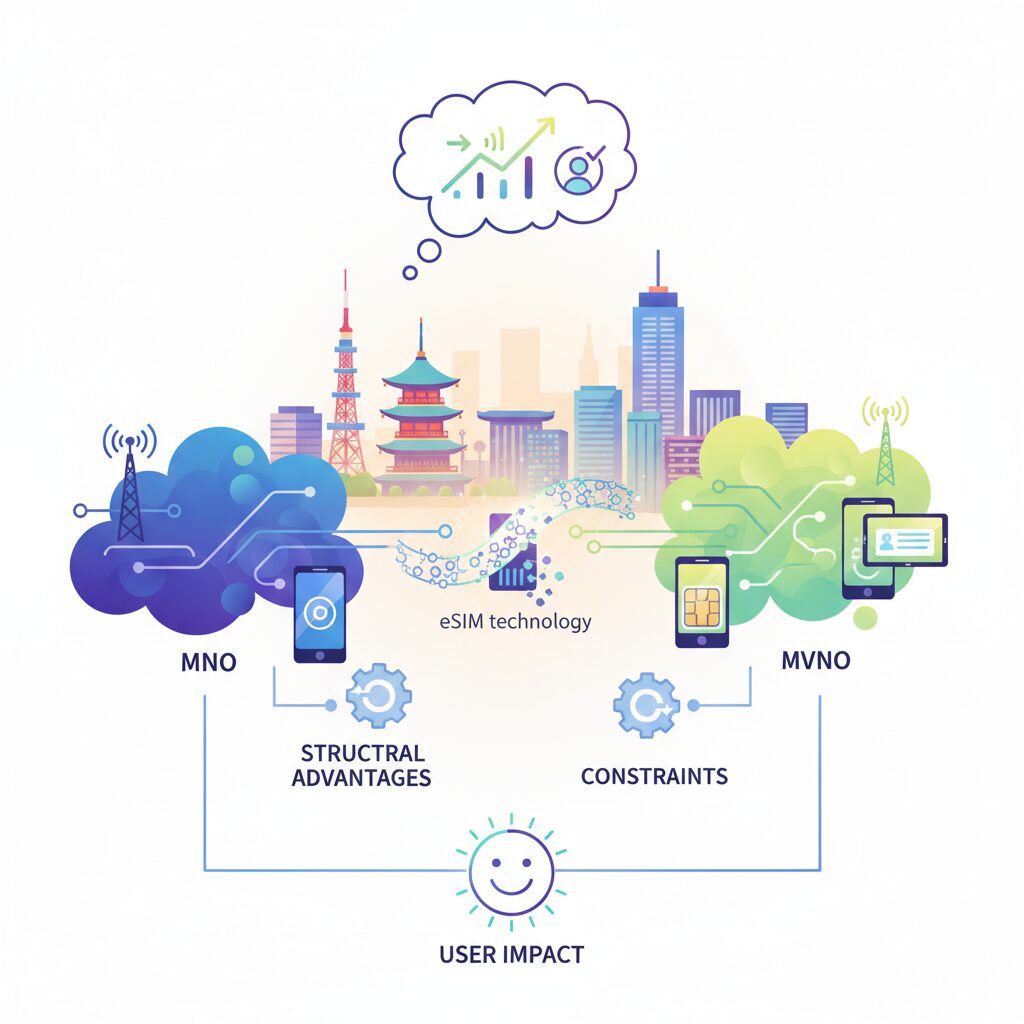

- MNO vs MVNO: Structural Advantages, Constraints, and User Impact

- GSMA Standards Explained: SGP.22, SGP.02, and the Rise of SGP.32

- iPhone eSIM Ecosystem: Quick Transfer and Seamless Mobility

- Android eSIM Today: Fragmentation, Progress, and Real-World Limitations

- Hidden Pitfalls When Switching eSIMs Across Japanese Carriers

- Battery Life, Dual SIM, and Hardware Trade-offs for Power Users

- Beyond eSIM: iSIM and the Future of Invisible Connectivity

- 参考文献

From Physical SIMs to Digital Freedom: Why eSIM Changes Everything

For decades, mobile connectivity has been anchored to a tiny piece of plastic. Physical SIM cards quietly dictated how easily users could switch carriers, activate new devices, or experiment with multiple networks. With eSIM, that long-standing constraint finally begins to dissolve, and users are gently guided toward a far more flexible model of connectivity.

At its core, eSIM transforms connectivity from a physical object into software. Instead of waiting for a SIM card to arrive by mail or visiting a retail store, users can download a carrier profile directly onto their device. According to discussions led by Japan’s Ministry of Internal Affairs and Communications, this shift dramatically lowers switching barriers and enables what policymakers describe as the democratization of connectivity.

| Aspect | Physical SIM | eSIM |

|---|---|---|

| Activation | Card insertion required | Digital download |

| Carrier switching | Days to complete | Often completed online |

| Device design | SIM slot needed | No slot required |

This change is not theoretical. The GSMA, which defines global mobile standards, reports that by the mid-2020s roughly one third of smartphones worldwide support eSIM. Japan stands out even more clearly. Industry estimates suggest that over 40 percent of smartphones shipped in Japan as early as 2020 already supported eSIM, largely due to the strong presence of iPhone. The hardware foundation has been in place well before users fully noticed its implications.

The real breakthrough lies in user freedom. Travelers can add a local data plan without removing their primary line. Gadget enthusiasts can test multiple carriers on a single device. Even everyday users benefit from faster onboarding, as identity verification and activation can now be completed entirely online. Researchers and regulators alike emphasize that this fluidity encourages competition, pushing carriers to improve pricing and service quality.

At the same time, eSIM subtly reshapes how devices are built. Removing the SIM slot frees internal space, improves water resistance, and simplifies global device variants. These engineering gains, noted repeatedly in GSMA technical documentation, reinforce why manufacturers increasingly treat eSIM not as an option, but as a default.

By replacing plastic with code, eSIM does more than modernize activation. It redefines the balance of power between users and networks, gently shifting control back into the hands of those who value choice, speed, and digital freedom.

Japan’s Unique eSIM Landscape and Global Market Position

Japan’s eSIM environment is often described as paradoxical, and this characterization is accurate. **From a hardware perspective, Japan has been one of the most eSIM-ready markets in the world**, yet from a service and user-experience perspective, its full potential has only recently begun to materialize. This gap between readiness and realization defines Japan’s unique position in the global eSIM landscape.

According to industry estimates cited by the Ministry of Internal Affairs and Communications and GSMA-related analyses, more than 40% of smartphones shipped in Japan as early as 2020 already supported eSIM. This figure was significantly higher than the global average at the time and was largely driven by the overwhelming dominance of the iPhone in the Japanese market. Apple’s early and consistent adoption of eSIM created a hardware foundation that many other regions only achieved several years later.

| Market | eSIM-ready smartphones (early 2020s) | Main driver |

|---|---|---|

| Japan | 40%+ of shipments | High iPhone market share |

| Global average | Below 30% | Fragmented OS and OEM mix |

However, **hardware readiness did not immediately translate into a fluid eSIM market**. Unlike regions such as parts of Europe or North America, where MVNOs aggressively embraced digital onboarding, Japan’s mobile ecosystem remained structurally conservative. Major mobile network operators continued to rely on physical SIM distribution and in-store procedures, effectively preserving traditional switching frictions even as eSIM technology was available.

This structural hesitation stands in contrast to global trends. GSMA projections indicate that by the mid-2020s, over one-third of all smartphones worldwide support eSIM as standard, and in some emerging markets, eSIM is viewed as a leapfrogging tool to bypass physical logistics entirely. In Japan, by comparison, **eSIM adoption has been less about access and more about controlled liberalization**, shaped heavily by regulatory guidance rather than pure market pressure.

A defining feature of Japan’s position is the active role of policy. The Ministry of Internal Affairs and Communications has explicitly framed eSIM as an enabler of fair competition and consumer mobility. Reports from its switching facilitation initiatives emphasize that digital SIM provisioning can lower psychological and procedural barriers to carrier change. This policy-driven narrative is less pronounced in many overseas markets, where eSIM diffusion is often led by device makers or global travel use cases.

At the same time, Japan differs from global peers in user behavior. Research bodies such as MMD Research Institute suggest that Japanese consumers, especially non-enthusiasts, place a high value on reliability and support. As a result, **the global image of eSIM as a frictionless, self-service technology has been partially softened in Japan**, where carriers emphasize guidance, staged rollouts, and risk mitigation.

From a global standpoint, this makes Japan a test case rather than a follower. It demonstrates how eSIM can coexist with strong incumbents, dense retail networks, and cautious consumers. **Japan’s eSIM market does not prioritize speed, but stability**, and this approach offers valuable lessons for mature telecom markets facing similar demographic and competitive constraints.

In this sense, Japan occupies a distinctive middle ground. It is neither an emerging market using eSIM to overcome infrastructure gaps, nor a fully liberalized market driven solely by digital-first MVNOs. Instead, it represents a highly advanced, tightly regulated environment where eSIM is gradually reshaping competition from within, positioning Japan as a quiet but influential reference point in the global eSIM conversation.

Government Policy and Competition: Inside Japan’s Switching Facilitation Efforts

Japan’s push to accelerate eSIM switching is not merely a technical upgrade but a deliberate policy intervention aimed at reshaping competitive dynamics in the mobile market. At the center of this effort is the Ministry of Internal Affairs and Communications, which has framed eSIM as a practical tool for lowering psychological, procedural, and time-based barriers that historically discouraged consumers from changing carriers.

According to official discussions within the Switching Facilitation Task Force, the core objective is clear: **reduce switching friction to the point where choosing a carrier becomes a reversible, low-risk decision**. This stance reflects the ministry’s long-standing concern that Japan’s mobile market, while technologically advanced, has suffered from limited effective competition due to high customer inertia.

From a policy perspective, eSIM aligns neatly with the government’s broader digital transformation agenda. By combining eSIM with online identity verification, regulators envision near-instant mobile number portability conducted entirely online. This contrasts sharply with the legacy model, where physical SIM delivery or in-store visits acted as de facto cooling-off periods.

| Policy Lever | Before eSIM | After eSIM Adoption |

|---|---|---|

| Switching Time | Several days | Minutes to hours |

| User Effort | Physical SIM handling | Digital-only process |

| Carrier Lock-in | High | Structurally reduced |

However, the same policy documents reveal a subtle tension between regulators and major mobile network operators. Large carriers publicly support eSIM diffusion, yet repeatedly highlight operational risks such as user support complexity and failed profile downloads. **These concerns are valid at a technical level, but they also intersect with economic incentives**, as eSIM weakens the value of physical retail channels that have traditionally supported upselling and ecosystem lock-in.

Industry observers familiar with regulatory proceedings note that the ministry has acknowledged these operational risks while maintaining its position that they do not outweigh the long-term benefits of competition. The implicit message is that **support costs are a normal consequence of a fairer market**, not a justification for maintaining friction.

Another critical dimension of the government’s strategy lies in how competition is structured between major carriers and MVNOs. Task Force materials point out that limited access to essential eSIM provisioning functions has placed MVNOs at a structural disadvantage. Without practical access to remote SIM provisioning infrastructure, smaller providers struggle to offer seamless switching experiences comparable to those of major carriers.

This imbalance matters because MVNOs play an outsized role in price discipline and service experimentation. Research cited in policy discussions shows that MVNO users report high satisfaction despite small market share, suggesting that **lower switching costs could amplify their competitive impact**. From a regulatory standpoint, enabling MVNO eSIM functionality is less about protecting niche players and more about sustaining long-term market pressure.

International standards bodies such as the GSMA are frequently referenced in these discussions, underscoring that Japan’s approach is not isolated. By aligning domestic rules with global eSIM specifications, regulators reduce the risk that Japanese consumers face unique constraints compared with overseas markets. This global consistency also strengthens Japan’s negotiating position when encouraging carriers to modernize their systems.

For competition policy experts, the significance of these efforts lies in their cumulative effect. Each individual measure may appear incremental, but together they redefine the default relationship between users and carriers. **When switching becomes easy, retention must be earned continuously**, not protected by procedural complexity.

Ultimately, Japan’s switching facilitation policy treats eSIM as infrastructure for competition rather than a consumer convenience feature. This framing explains the persistence with which regulators continue to press carriers, even amid operational objections. The underlying belief, shared by many economists and telecommunications scholars, is that markets innovate faster and price more efficiently when exit is frictionless.

For gadget-savvy consumers, these policy moves translate into something tangible: genuine leverage. As government pressure gradually normalizes instant, online switching, competitive differentiation shifts away from inertia and toward service quality, pricing transparency, and ecosystem value. That shift, while subtle, marks a structural change in how mobile connectivity is governed in Japan.

MNO vs MVNO: Structural Advantages, Constraints, and User Impact

When comparing MNOs and MVNOs in the context of eSIM, the most important difference lies not in pricing but in structural control. MNOs own radio access networks, core networks, and subscriber databases, while MVNOs depend on wholesale access to those layers. **This asymmetry directly shapes how quickly each side can adopt new eSIM features and how seamless the user experience becomes.**

According to discussions published by Japan’s Ministry of Internal Affairs and Communications, MNOs retain full authority over Remote SIM Provisioning servers and subscriber profile lifecycle management. This allows them to integrate eSIM deeply into their operational systems, including online identity verification and near‑instant MNP switching. MVNOs, by contrast, must either negotiate access to these functions or build costly parallel systems, which is often economically unrealistic.

| Aspect | MNO | MVNO |

|---|---|---|

| Network ownership | Owns radio and core network | Leases network from MNO |

| eSIM profile control | Full control via RSP infrastructure | Limited or indirect control |

| Feature rollout speed | Fast and OS‑level integrated | Slower, portal‑based |

This structural gap becomes especially visible in advanced features such as eSIM Quick Transfer on iPhone. Apple’s implementation relies on tight coordination between the OS and carrier backend. Major MNOs and their sub‑brands can support this end‑to‑end flow, while many MVNOs still require manual reissuance through web portals, sometimes with additional fees. **For gadget enthusiasts who upgrade devices frequently, this difference translates into real friction.**

Interestingly, market data from MMD Research Institute shows that although MNOs control over 90% of subscriber share in Japan, independent MVNOs often score higher in customer satisfaction surveys. This suggests that informed users consciously trade structural limitations for cost efficiency and flexibility. In other words, MVNO constraints are tolerated when users understand them and factor them into their usage patterns.

From a cost perspective, MNOs also face hidden disadvantages. Operating nationwide networks and retail storefronts creates heavy fixed costs, which partly explains higher base fees. MVNOs avoid these burdens, allowing aggressive pricing and niche services. However, when eSIM lowers switching barriers, MNOs increasingly rely on ecosystem lock‑in such as payment platforms and point programs to compensate for their loss of physical control.

Ultimately, the impact on users depends on priorities. **MNOs excel in immediacy, automation, and tight OS integration**, which benefits power users who value time and smooth device transitions. **MVNOs excel in economic efficiency and community‑driven value**, appealing to users who accept occasional manual steps. Understanding these structural realities allows readers to choose not just a plan, but a connectivity model aligned with their digital lifestyle.

GSMA Standards Explained: SGP.22, SGP.02, and the Rise of SGP.32

Understanding eSIM at a practical level requires familiarity with the GSMA standards that quietly govern how profiles are issued, moved, and controlled. In consumer devices today, SGP.22 is the dominant specification, defining how smartphones securely download eSIM profiles via QR codes or activation flows. According to GSMA documentation, this design intentionally places the user in control, which helps protect privacy but also introduces friction when devices are changed frequently.

In contrast, industrial and automotive deployments historically relied on SGP.02. This standard enables server-driven profile management, which is efficient at scale but has been criticized by connectivity researchers for reinforcing vendor lock-in. Once a device is tied to a specific subscription manager, switching operators becomes operationally complex, a limitation repeatedly highlighted in GSMA working group discussions.

| Standard | Primary Use | Control Model |

|---|---|---|

| SGP.22 | Smartphones, tablets | User-initiated |

| SGP.02 | Automotive, M2M | Server-driven |

| SGP.32 | IoT, wearables | Remote + flexible |

The emergence of SGP.32 marks a structural shift. GSMA positions it as a unifying framework that blends consumer-grade flexibility with remote manageability. Analysts at Wireless Logic and Onomondo note that SGP.32 removes the hard dependency on legacy subscription managers, enabling lighter devices such as trackers or smart glasses to switch networks without screens or manual input.

For gadget enthusiasts, this matters because SGP.32 quietly extends eSIM beyond phones. It suggests a near future where connectivity is abstracted, device-agnostic, and far more liquid, aligning with GSMA’s long-term vision of scalable, interoperable digital identity for connected hardware.

iPhone eSIM Ecosystem: Quick Transfer and Seamless Mobility

The iPhone eSIM ecosystem represents one of the most mature and frictionless implementations of digital connectivity today, and its core strength lies in Quick Transfer and seamless mobility. With iOS 16 and later, Apple fundamentally changed how users move their mobile identity between devices, reducing what used to be a carrier-driven procedure into a user-centric experience.

eSIM Quick Transfer allows an active mobile subscription to be moved directly between nearby iPhones using Bluetooth, without logging into a carrier portal or waiting for a new QR code. From a user perspective, the process feels closer to AirDrop than a telecom procedure, reinforcing Apple’s philosophy that connectivity should be invisible rather than negotiated.

| Aspect | Physical SIM Era | iPhone eSIM Quick Transfer |

|---|---|---|

| Transfer trigger | Carrier reissue request | On-device user action |

| Time required | Hours to days | Minutes |

| User dependency | Store or web support | iOS settings only |

This fluidity is not accidental. According to GSMA specifications for consumer eSIM, control is intentionally placed in the user’s hands, and Apple has fully embraced this design. By integrating carrier authentication, device-level encryption, and proximity-based verification, Quick Transfer preserves security while dramatically lowering switching friction.

In Japan, this feature exposes a clear hierarchy within the carrier ecosystem. Major MNOs and their sub-brands support Quick Transfer end to end, enabling device upgrades without administrative overhead. In contrast, most MVNOs still require manual reissuance via web portals, often with small fees and additional waiting time.

Apple’s ecosystem advantage extends beyond iPhones. iPad cellular models also support eSIM-based activation, allowing users to dynamically assign data plans only when needed. This has popularized usage patterns such as temporary data activation for travel or remote work, something that was impractical with fixed physical SIMs.

Industry observers, including commentary aligned with Apple’s platform strategy and GSMA guidelines, note that this level of mobility subtly shifts bargaining power toward users. While carriers still control pricing and network quality, the act of moving becomes trivial, and that psychological shift matters.

The result is an ecosystem where connectivity behaves more like a digital asset than a physical contract. For users deeply invested in Apple hardware, eSIM Quick Transfer is not just a convenience feature but a structural advantage that redefines what “owning” a mobile line actually means.

Android eSIM Today: Fragmentation, Progress, and Real-World Limitations

Android eSIM support in 2026 stands at an intriguing crossroads, where technical progress is undeniable yet everyday usability still feels uneven. From a distance, Android appears to have caught up with iOS, as most flagship devices from Google and Samsung now support eSIM by default. However, once users attempt real-world migration, especially device-to-device transfer, the experience often reveals the platform’s deeper fragmentation.

Google formally announced Android’s native eSIM transfer framework at MWC Barcelona in 2023, emphasizing alignment with GSMA consumer standards. According to reporting by respected industry media covering hands-on testing, successful transfers have been confirmed between certain Pixel and Galaxy models under specific carrier conditions. This demonstrates that the underlying architecture works. The limitation is not the eSIM standard itself, but the dependency on OEM and carrier-side implementation.

| Aspect | Android Reality | User Impact |

|---|---|---|

| Device support | Pixel and Galaxy prioritized | Other brands lag behind |

| Carrier compatibility | Limited MNO approval | Manual reissue often required |

| Transfer method | UI-driven but conditional | Success varies by combination |

In practical terms, many Android users still rely on the traditional reissuance flow: logging into a carrier portal, requesting a new eSIM profile, and scanning a QR code. Regulatory discussions led by Japan’s Ministry of Internal Affairs and Communications have acknowledged that this process requires higher ICT literacy and stable Wi-Fi access, which carriers themselves cite as operational risk factors. These concerns explain why some operators deliberately slow broader enablement.

Another often-overlooked constraint lies in Android’s diverse hardware ecosystem. Unlike Apple’s tightly controlled environment, Android manufacturers customize system layers, including eSIM management interfaces. As a result, even when GSMA-compliant features exist at the OS level, they may be hidden, modified, or delayed by vendor skins. This structural diversity, while a strength for innovation, directly translates into inconsistent eSIM UX.

Authoritative analysis from GSMA-affiliated experts consistently points out that eSIM’s promise depends on end-to-end coordination. Android illustrates this clearly: the OS, chipset vendor, device manufacturer, and carrier must all align. When any link fails, users experience friction. This is why early adopters report smooth transfers on flagship Pixels under major carriers, while mid-range devices or MVNO lines remain excluded.

Still, progress is visible. Battery efficiency improvements in modern modems mean that Dual SIM Dual VoLTE operation on Android no longer carries the severe power penalties seen in earlier generations. Independent endurance tests cited across the industry confirm that contemporary devices sustain all-day usage even with multiple active profiles. This removes a historical deterrent and makes eSIM genuinely practical for daily Android use.

Today’s Android eSIM landscape can therefore be summarized as functional but conditional. It rewards users who choose compatible hardware and carriers, while penalizing those outside the narrow compatibility matrix. For gadget enthusiasts, Android eSIM is no longer experimental, but it is still not universally frictionless. Until broader carrier approval and OEM standardization mature, Android remains a platform where eSIM potential is clear, yet its full convenience is selectively accessible.

Hidden Pitfalls When Switching eSIMs Across Japanese Carriers

Switching eSIMs across Japanese carriers looks effortless on the surface, but in practice there are several hidden pitfalls that even tech‑savvy users often overlook. **The core issue is that eSIM is standardized at the GSMA level, while its actual operation is deeply shaped by carrier‑specific policies and legacy systems**. This gap becomes visible only when you attempt to move between carriers, not when you first activate an eSIM.

One of the most common traps is the assumption that eSIM portability is symmetric. In reality, Japanese MNOs and MVNOs operate under very different constraints. According to discussions within the Ministry of Internal Affairs and Communications’ Switching Facilitation Task Force, large carriers retain more control over Remote SIM Provisioning infrastructure, while many MVNOs depend on limited access to those functions. As a result, switching away from an MVNO often requires manual reissuance procedures that feel closer to physical SIM days.

| Scenario | User Expectation | Actual Outcome |

|---|---|---|

| MNO to MNO | Instant profile transfer | Usually seamless on iPhone |

| MVNO to MNO | Same as MNO transfer | New QR code often required |

| MNO to MVNO | Quick online switch | Waiting time and fees may apply |

Another subtle risk lies in network feature inheritance. **An eSIM profile does not always migrate advanced network capabilities**, such as 5G SA eligibility or VoLTE priority settings. Carrier documentation confirms that certain plans silently downgrade features when an eSIM is reissued rather than transferred. Users may only notice this after experiencing slower uplink speeds or unstable calls, making diagnosis difficult.

There is also an operational pitfall related to connectivity itself. eSIM activation requires a stable data connection, yet switching carriers often happens precisely when connectivity is weakest. KDDI has repeatedly pointed out that failed profile downloads generate more support cases than physical SIM swaps. If the download is interrupted, the original profile may already be invalidated, temporarily leaving the device without service.

Security considerations add another layer of complexity. **Because eSIM switching is online‑centric, it increases exposure to SIM swap attacks if account security is weak**. Industry experts and GSMA guidance emphasize multi‑factor authentication, but implementation varies by carrier. Some MVNO portals still rely on single‑factor login, which becomes a critical vulnerability during number portability.

Finally, ecosystem lock‑in can turn into an unexpected cost. Points programs and bundled services are not technically part of the eSIM, yet switching carriers can reset accumulated benefits. Research by MMD Laboratory shows that users embedded in major economic ecosystems hesitate to switch, even when eSIM makes it technically easy. The pitfall here is psychological rather than technical, but its impact on real switching behavior is significant.

For gadget enthusiasts, recognizing these hidden pitfalls transforms eSIM from a source of frustration into a strategic tool. Without that awareness, the promise of instant, frictionless switching remains only partially fulfilled.

Battery Life, Dual SIM, and Hardware Trade-offs for Power Users

For power users running multiple lines, battery life is no longer the obvious sacrifice it once was. **Dual SIM Dual VoLTE (DSDV)** keeps two radios on standby, which historically increased idle drain. However, recent measurements suggest the penalty has narrowed dramatically. Independent endurance testing of the iPhone 16 Pro Max recorded over twelve hours of continuous use, outperforming peers by more than an hour, indicating that modern modem efficiency has reached a point where dual-line usage does not meaningfully undermine daily longevity.

This shift is rooted in hardware evolution. According to GSMA-aligned modem design principles and industry analysis, newer baseband chips aggressively manage paging cycles and background signaling. In practical terms, a secondary eSIM used mainly for standby or low-volume data adds marginal overhead compared with active data sessions on both lines.

| Usage Pattern | Typical Impact | Practical Outcome |

|---|---|---|

| Single SIM | Baseline drain | All-day use with margin |

| Dual SIM (DSDV) | Slight idle increase | Negligible for most users |

That said, hardware trade-offs remain. Eliminating a physical SIM slot frees internal space for antennas or thermal buffers, but it also concentrates risk: **a failed eSIM profile or unstable Wi‑Fi during provisioning can temporarily cut all connectivity**. Regulators and carriers acknowledge this operational fragility, noting that reliable networks are essential during profile downloads.

For power users, the conclusion is nuanced. Dual SIM is now a sustainable default rather than a compromise, yet it rewards disciplined setup and awareness of hardware constraints. Battery anxiety has largely been solved; resilience and recovery planning are the new considerations.

Beyond eSIM: iSIM and the Future of Invisible Connectivity

As eSIM adoption reaches a practical maturity, attention is steadily shifting toward iSIM, or Integrated SIM, which represents the next logical step in making connectivity truly invisible. While eSIM already removed the need for a removable card, it still relies on a dedicated secure chip soldered onto the device’s board. iSIM goes further by embedding SIM functionality directly into the cellular modem or SoC itself, fundamentally changing how devices are designed and manufactured.

This architectural shift is not merely incremental; it directly affects size, power efficiency, and security. According to GSMA-aligned technical discussions and chipset roadmaps disclosed by vendors such as Qualcomm, integrating SIM logic into the modem can reduce board space and component count, which is especially valuable for ultra-compact devices like smart glasses, medical sensors, and industrial trackers.

| SIM Type | Physical Form | Integration Level | Primary Benefit |

|---|---|---|---|

| Physical SIM | Removable card | External slot | Easy replacement |

| eSIM | Embedded chip | On-device component | Remote provisioning |

| iSIM | No separate chip | Inside SoC/modem | Minimal size and power |

One often overlooked implication is power consumption. Research summarized by IoT connectivity specialists such as Wireless Logic indicates that iSIM can lower energy usage by eliminating redundant interfaces between the SIM and the modem. For battery-constrained devices that must operate for years, even small efficiency gains translate into tangible lifecycle benefits.

Security is another area where iSIM is frequently misunderstood. Because SIM credentials are executed within the SoC’s secure enclave, the attack surface is not inherently larger than eSIM. In fact, GSMA documentation emphasizes that iSIM implementations must meet the same certification levels as eUICC, including hardware-based root-of-trust requirements. This means that, from a standards perspective, iSIM is not a shortcut but a consolidation.

However, the future of invisible connectivity is not determined by hardware alone. Provisioning models remain critical. The emergence of the SGP.32 specification is particularly relevant here, as it allows remote lifecycle management without relying on user interfaces. Analysts following GSMA working groups note that iSIM paired with SGP.32 creates a scenario where devices can be manufactured once and dynamically connected anywhere, reducing regional SKU fragmentation.

In practical terms, this could reshape how global products are launched. Instead of producing Japan-specific or EU-specific cellular variants, manufacturers could ship a single hardware design and activate local connectivity at first power-on. This shifts connectivity from a manufacturing constraint to a software-defined capability.

As of the mid-2020s, iSIM is still in a transition phase from pilot projects to volume deployment. Industry consensus, reflected in commentary from semiconductor vendors and IoT platform providers, suggests that smartphones will adopt iSIM more cautiously, while wearables and IoT devices will lead. The reason is simple: these categories benefit most from space savings and long-term operational efficiency.

Ultimately, iSIM represents the culmination of a decades-long trend toward abstraction. SIM cards shrink, disappear, and finally dissolve into silicon logic. When connectivity becomes this seamless, users no longer think in terms of SIMs at all. They simply expect devices to be online, securely, instantly, and everywhere.

参考文献

- Ministry of Internal Affairs and Communications (Japan):Switching Facilitation Task Force Report (Draft)

- K-Tai Watch:Japan Publishes Draft Report on Smoother MNP Switching

- Wireless Logic:What Is SGP.32 eSIM? GSMA Standard for IoT SIMs

- Onomondo:Optimizing IoT with GSMA SGP.32: eSIM IoT vs M2M vs Consumer

- MMD Research Institute:Mobile Communication Market Research Data

- LINEMO:Announcement of eSIM Quick Transfer Support

- K-Tai Watch:Testing Android eSIM Transfer Between Galaxy and Pixel