Have you ever felt that uneasy moment when your wallet, keys, or bag is not where you expected it to be?

For gadget enthusiasts, smart tracking tags have quietly transformed that anxiety into confidence, and in 2026, this technology is evolving faster than ever before.

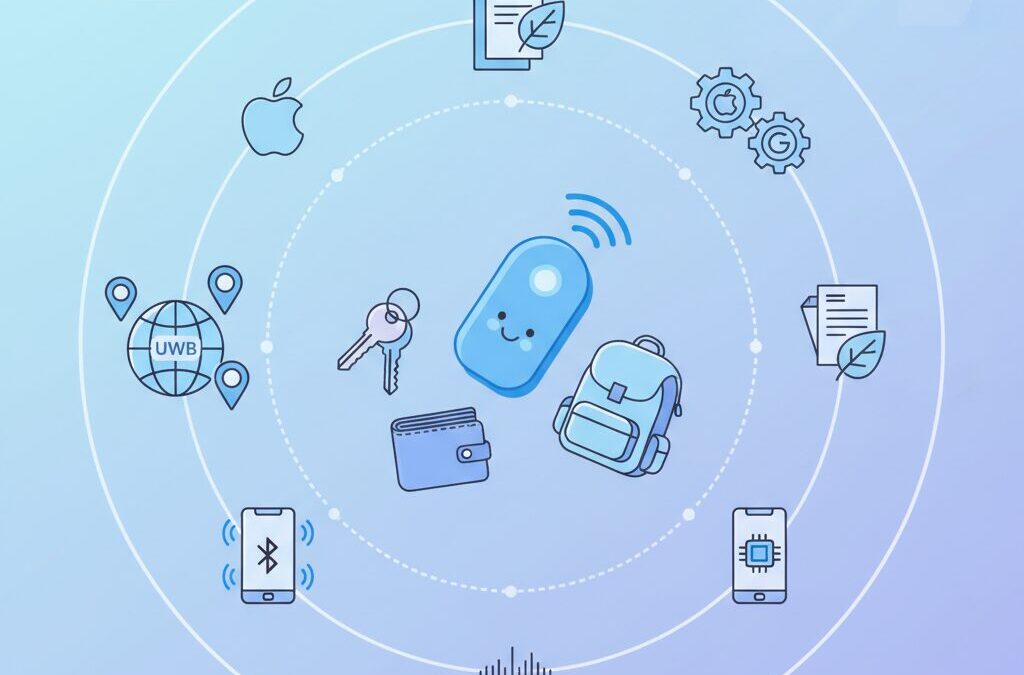

What began as simple Bluetooth beepers has grown into a global location infrastructure powered by billions of smartphones, ultra-precise UWB radios, and even battery-free research breakthroughs.

In this article, you will discover why smart trackers are no longer just accessories, but a reflection of deeper shifts in technology, privacy, and everyday life.

You will learn how Apple and Google are fighting a silent platform war, how new laws are reshaping responsible use, and how cutting-edge academic research is pushing accuracy and sustainability to new limits.

By the end, you will be able to understand where this market is heading, which technologies truly matter, and how smart tracking is redefining what it means to “own” physical objects in a connected world.

- From Personal Responsibility to Networked Ownership

- Global Smart Tracker Market Growth and Key Economic Drivers

- Why Asia-Pacific Is the Next Growth Engine

- Apple Find My Network and the Power of Ecosystem Integration

- Google Find My Device Network: Privacy-First Design and Its Trade-Offs

- How Independent Brands Survive Without an OS Platform

- Bluetooth LE vs UWB: The Physics Behind Precision Finding

- Standardization and Safety: Detecting Unwanted Location Trackers

- Battery-Free Tracking and the Rise of Energy Harvesting

- Real-World Use Cases: Cars, Pets, and Logistics Transformation

- Legal and Ethical Challenges Shaping the Future of Tracking

- 参考文献

From Personal Responsibility to Networked Ownership

The idea of ownership has quietly shifted over the past few years, and smart tracking tags sit at the center of that change. Losing a wallet or a set of keys used to be framed as a purely personal failure, something solved by better habits or sharper attention. Today, responsibility is increasingly distributed across devices, operating systems, and even strangers’ smartphones, forming a networked safety net around everyday objects.

This transition from personal responsibility to networked ownership is not a metaphor but a technical reality. Modern trackers no longer rely on a single owner actively searching. Instead, they leverage crowdsourced detection through billions of connected devices. According to platform disclosures from Apple and Google, location updates are generated passively when nearby phones encounter a tag, even if the owner is offline. Ownership therefore becomes participatory, embedded in an invisible social infrastructure.

| Aspect | Traditional Ownership | Networked Ownership |

|---|---|---|

| Responsibility | Individual vigilance | Distributed across devices |

| Recovery method | Manual searching | Passive crowd detection |

| Failure cost | Borne by owner alone | Shared via platform network |

Academic research on ubiquitous computing has long predicted this outcome. Scholars at institutions such as MIT and Stanford have argued that as sensing becomes ambient, accountability migrates from humans to systems. Smart trackers operationalize that theory at consumer scale. When a misplaced bag is located because another commuter’s phone silently relays its position, the concept of “my responsibility” subtly dissolves.

This does not eliminate human agency; it reframes it. Users opt into ecosystems, accept platform rules, and trust cryptographic safeguards. In exchange, they gain resilience that no individual effort could match. Networked ownership thus represents a new social contract for physical goods, one where losing something no longer means being alone with the problem.

Global Smart Tracker Market Growth and Key Economic Drivers

The global smart tracker market has been experiencing robust expansion, and this growth is not accidental but economically well-grounded. According to consolidated market analyses by organizations such as IMARC Group and Mordor Intelligence, the market size reached approximately 4.96 billion USD in 2025 and is projected to grow to over 17.3 billion USD by 2034. **This corresponds to a CAGR of nearly 15%, which is significantly higher than the average growth rate of the broader consumer electronics sector.**

This momentum is largely driven by structural changes in how value and risk are managed in daily life and business. From an economic perspective, smart trackers are increasingly perceived as low-cost insurance tools. Consumers are more willing to invest a few dozen dollars to protect high-value items such as laptops, bicycles, and travel luggage, especially in urban environments where loss and theft risks are statistically higher.

On the enterprise side, logistics and supply chain optimization plays a crucial role. Research and Markets points out that last-mile visibility has become a competitive differentiator in e-commerce. Companies are no longer satisfied with shipment-level tracking; instead, item-level and container-level visibility is being adopted to reduce loss, shrinkage, and operational inefficiencies.

| Economic Driver | Primary Beneficiary | Impact on Demand |

|---|---|---|

| Last-mile logistics visibility | E-commerce, 3PLs | Higher B2B adoption |

| Rising asset values | Consumers | Increased per-capita usage |

| Aging population | Healthcare, public sector | New social infrastructure demand |

Regionally, North America still accounts for the largest revenue share at just over 37% as of 2025. However, **the Asia-Pacific region is expected to be the fastest-growing market**, with an estimated annual growth rate exceeding 13% through the early 2030s. Analysts attribute this to rapid smartphone penetration, expanding middle-class consumption, and government-backed digital transformation initiatives.

Japan presents a particularly instructive case. Beyond consumer convenience, smart trackers are increasingly deployed as part of social safety systems. For example, solutions used in elderly care facilities leverage tracking tags to prevent wandering incidents among dementia patients. Industry observers note that this reframes smart trackers from optional gadgets into essential risk-mitigation infrastructure.

In summary, the market’s growth is supported by clear economic logic: declining unit costs, expanding network effects, and quantifiable reductions in loss-related expenses. **As these benefits become easier to measure in financial terms, adoption continues to accelerate across both consumer and institutional markets.**

Why Asia-Pacific Is the Next Growth Engine

The Asia-Pacific region is increasingly recognized as the most promising growth engine for smart trackers and location technologies, and this momentum is supported by clear structural factors rather than short-term trends. According to Mordor Intelligence, APAC is projected to achieve the fastest compound annual growth rate globally from 2026 onward, outpacing North America despite the latter’s current market dominance. **This shift reflects not only population scale, but also how deeply digital services are woven into everyday life across Asian cities.**

One decisive advantage of APAC lies in its dense urban environments. Mega-cities such as Tokyo, Seoul, Shanghai, and Singapore create ideal conditions for BLE-based crowd networks, where high foot traffic directly translates into higher location update frequency. Research and Markets has noted that network density is a key performance multiplier for smart trackers, and APAC’s urban structure naturally amplifies this effect. **In practical terms, a tag in central Tokyo is far more likely to be detected than one in a sparsely populated suburb in other regions.**

| Factor | Asia-Pacific | North America |

|---|---|---|

| Urban density | Very high in major metros | Moderate to high |

| Smartphone penetration | Rapidly expanding | Mature and saturated |

| Primary growth driver | New users and use cases | Replacement demand |

Another powerful driver is demographic change. Japan, in particular, is facing an unprecedented aging society, and smart trackers are increasingly viewed as social infrastructure rather than consumer gadgets. Case studies published by Takachiho Trading show that tags used in elderly care facilities can reduce response times to wandering incidents and ease staff workload. **This reframes location technology as a public-safety tool, expanding demand beyond individual consumers into institutional procurement.**

APAC also benefits from policy and platform dynamics. Google’s Find My Device network, which began full-scale deployment in Japan in 2025, is still maturing, yet its long-term potential is significant due to Android’s strong regional share. Analysts cited by CNET emphasize that once participation thresholds are reached, network effects accelerate rapidly. **For APAC markets with millions of mid-range Android devices, this creates a delayed but powerful growth curve.**

Finally, cost sensitivity in many Asian markets encourages experimentation with low-price, high-volume models. The success of affordable tags sold through mass retailers in Japan demonstrates how price elasticity can unlock entirely new segments. **This combination of scale, density, and socially embedded use cases explains why Asia-Pacific is not just catching up, but redefining the trajectory of the global smart tracker market.**

Apple Find My Network and the Power of Ecosystem Integration

The true strength of Apple’s Find My network lies not in the AirTag hardware itself, but in the way the entire ecosystem works together seamlessly. When an AirTag is separated from its owner, it can anonymously leverage nearby iPhones, iPads, and Macs as relay points, all without user intervention. According to Apple’s platform architecture disclosures, this process is end-to-end encrypted, meaning even Apple cannot see the identity of the device or the owner. This design transforms hundreds of millions of active Apple devices into a passive global sensor network, something no standalone tracker company could realistically replicate.

What makes this ecosystem particularly powerful is the default participation model. Because Find My is built directly into iOS, iPadOS, and macOS, users do not need to install or configure additional apps. As security researchers cited by institutions such as the Electronic Frontier Foundation have pointed out, this opt-out rather than opt-in structure dramatically increases network density, especially in urban areas. From a purely probabilistic standpoint, the likelihood that a lost item will be detected increases exponentially with node density, and Apple benefits from one of the largest installed bases in consumer technology.

| Aspect | Find My Network Characteristic | User Impact |

|---|---|---|

| Network Nodes | iPhone, iPad, Mac active by default | High discovery probability even without app installs |

| Location Precision | UWB-based Precision Finding | Centimeter-level guidance indoors |

| Privacy Model | Rotating identifiers and encryption | Strong resistance to mass tracking abuse |

Another key element is Apple’s vertical integration. By controlling both the silicon and the operating system, Apple enables features such as Precision Finding using its U1 and U2 chips. Academic research published through IEEE has shown that UWB-based ranging significantly outperforms RSSI-based Bluetooth estimation in cluttered indoor environments. In practical terms, this means users are not just told that an item is “nearby,” but are guided with directional arrows and distance readouts. This reduces search time from minutes to seconds, a subtle but meaningful shift in daily usability.

The ecosystem advantage also extends beyond Apple-branded products. Through the Find My Network Accessory Program, third-party manufacturers such as Belkin and Chipolo are allowed to integrate their products into the same network. Industry analysts quoted by Bloomberg have noted that this strategy strengthens the ecosystem without diluting Apple’s core differentiation, since advanced UWB capabilities remain exclusive to AirTag. For users, this creates a layered market where price, form factor, and integration depth can be chosen without leaving the ecosystem.

From a marketing and platform perspective, this integration produces strong lock-in effects. Once users rely on Find My for keys, bags, bicycles, and even family devices, switching away from the Apple ecosystem carries a tangible cost. As MIT Sloan’s research on platform economics suggests, such ecosystem-level value often outweighs incremental hardware improvements. In this sense, Apple’s Find My network demonstrates how location technology becomes most powerful when it disappears into the background, quietly supported by an ecosystem designed to work as one.

Google Find My Device Network: Privacy-First Design and Its Trade-Offs

Google’s Find My Device Network has been built around a philosophy that places user privacy ahead of raw tracking performance, and this design choice clearly differentiates it from competing ecosystems. The most distinctive element is its default aggregation logic, where a lost tag’s location is only reported when it has been detected by multiple Android devices in close temporal and spatial proximity. This approach dramatically reduces the risk of covert tracking, a concern that has been widely discussed by privacy researchers and civil liberties organizations.

From a privacy engineering standpoint, Google’s stance aligns closely with principles advocated by institutions such as the Electronic Frontier Foundation, which has long argued that large-scale location networks should minimize single-device observability. By avoiding scenarios where a lone passerby’s phone can reveal a precise location, Google limits the creation of unintended location trails. In densely populated urban areas, this model can still function effectively, as device density compensates for the higher reporting threshold.

However, the same mechanism introduces tangible trade-offs that advanced users quickly notice. In suburban or rural environments, or in regions where Android participation in the network is lower, location updates can become sporadic or fail to appear altogether. The network favors anonymity over immediacy, and that balance can be frustrating when tracking high-value items or time-sensitive losses.

| Design Aspect | Privacy Impact | Practical Consequence |

|---|---|---|

| Multi-device aggregation | Prevents single-device tracking | Delayed or missing updates in low-density areas |

| Encrypted, rotating identifiers | Limits long-term correlation | Harder to debug or verify network behavior |

| Opt-out aware defaults | Respects user consent | Smaller effective sensing population |

Academic discussions around privacy-preserving location systems, including papers published through IEEE venues, suggest that aggregation-based reporting is one of the most effective safeguards against misuse, but they also acknowledge the inherent loss of spatial resolution. Google appears to have deliberately accepted this loss, betting that societal trust and regulatory compliance will matter more in the long term than headline-grabbing accuracy figures.

For users, this means understanding that Find My Device is not designed to be an always-on surveillance mesh. It is instead a cooperative safety net that works best when many participants are present and willing. The network’s reliability is therefore a social variable, not just a technical one. This framing helps explain why Google continues to emphasize privacy-first messaging, even in the face of criticism about coverage gaps.

Ultimately, Google’s design illustrates a broader industry dilemma: every layer of privacy protection introduces friction. By choosing aggregation as a default, Google signals that it prioritizes preventing harm over maximizing convenience, a decision that will resonate strongly with privacy-conscious users while leaving power users weighing whether that compromise fits their own risk tolerance.

How Independent Brands Survive Without an OS Platform

Independent smart tracker brands face a structural disadvantage because they do not control an operating system–level discovery network. Apple and Google can turn billions of smartphones into passive search nodes by default, while independent players must actively convince users to install apps or deploy hardware. **Survival, therefore, depends not on competing head‑on, but on redefining what “value” means in tracking.**

One proven approach is narrowing the problem space. Tile, now under Life360, deliberately shifted away from pure object recovery and toward personal safety. According to Life360’s own disclosures, Tile devices are increasingly positioned as dual‑use tools: trackers for belongings that also function as SOS buttons and proximity alarms. This reframing aligns with Life360’s family location‑sharing platform, where the emotional value of safety outweighs raw location accuracy.

MAMORIO represents a different, infrastructure‑centric strategy. Instead of relying on crowdsourced smartphones, it built the MAMORIO Spot network by installing dedicated receivers in railway stations and transport facilities across Japan. **This choice trades global reach for deterministic detection**, a trade‑off that resonates with commuters who value certainty over theoretical coverage.

| Brand | Core Dependency | Primary Value Proposition |

|---|---|---|

| Tile | Life360 user base | Personal safety + item tracking |

| MAMORIO | Dedicated Spot antennas | Reliable recovery in transit hubs |

| OS Platforms | iOS / Android defaults | Massive passive search networks |

Battery longevity is another lever where independent brands can still differentiate. MAMORIO’s multi‑year battery designs reduce maintenance friction, a factor that academic research and field studies consistently identify as a key barrier to long‑term IoT adoption. **A tracker that never needs attention quietly becomes part of daily life**, which strengthens brand trust even without OS‑level advantages.

Regulation has also reshaped competitive dynamics. After Japan’s 2025 revision of the Stalker Regulation Act, all manufacturers are pressured to implement misuse‑prevention features. For independent brands, early compliance is not just legal hygiene but a reputational asset. By openly communicating safeguards and cooperating with cross‑platform detection standards discussed at the IETF, smaller players signal responsibility rather than opacity.

Finally, partnerships substitute for platforms. Tile’s integration with Life360 and MAMORIO’s collaboration with transport operators illustrate how alliances can approximate ecosystem effects without owning an OS. Analysts at Research and Markets note that such hybrid models are increasingly common in IoT segments where network effects are otherwise monopolized.

In practice, independence no longer means universality. It means **designing for specific human anxieties—safety, routine, and certainty—rather than abstract global coverage**. Brands that internalize this shift do not merely survive; they remain meaningfully relevant alongside platform giants.

Bluetooth LE vs UWB: The Physics Behind Precision Finding

When people experience Precision Finding for the first time, the difference between Bluetooth LE and UWB feels almost magical, but the roots of that experience lie firmly in physics. Bluetooth Low Energy was never designed to answer the question “Where exactly is my item?” Instead, it answers a simpler one: “Is it roughly nearby?” This fundamental distinction explains why BLE-based finding often feels vague, while UWB feels spatially aware.

Bluetooth LE estimates distance using RSSI, the received signal strength indicator. In theory, weaker signals mean greater distance, but in real environments radio waves bounce off walls, furniture, and even human bodies. According to analyses widely cited in IEEE communications research, these multipath effects can introduce errors of several meters indoors, even when devices are only a few steps apart. **This is why BLE can tell you that a tag is somewhere in the room, but not which corner it is hiding in.**

UWB approaches the problem from an entirely different physical angle. Instead of measuring signal strength, it measures time. By sending extremely short pulses across a very wide frequency band, UWB can calculate Time of Flight with nanosecond-level precision. Because radio waves travel at a constant speed, this allows distance to be calculated directly, largely independent of signal reflections.

Research published through IEEE Xplore in 2025 demonstrated that raw UWB ranging can already achieve accuracy on the order of tens of centimeters. More importantly, when researchers fused UWB data with smartphone motion sensors such as step length and heading, average positioning error was reduced from about 0.59 meters to 0.22 meters in indoor tests. **This fusion of physics and sensor data is what makes arrow-based guidance feel so stable and trustworthy.**

| Aspect | Bluetooth LE | UWB |

|---|---|---|

| Primary measurement | Signal strength (RSSI) | Time of Flight |

| Typical indoor error | Several meters | Centimeters |

| Direction awareness | Not available | Supported via AoA |

Another crucial difference is direction. BLE has no native way to determine where a signal is coming from, so apps rely on trial and error. UWB, by contrast, supports Angle of Arrival, allowing the phone to understand not just how far away an object is, but in which direction it lies. **This transforms finding from a guessing game into a guided movement through space.**

Industry engineers often note that BLE and UWB are not rivals so much as complementary tools. BLE remains extremely efficient for low-power broadcasting across large crowds, which is why it underpins global finding networks. UWB activates only at close range, where precision matters most. Apple and Android device makers have independently converged on this hybrid model, not by accident, but because the physics of radio propagation leave little alternative.

In practical terms, the physics behind UWB explain why Precision Finding feels less like checking a map and more like using a sixth sense. It is not better software alone, but a measurement method fundamentally aligned with how distance and direction actually work in the physical world.

Standardization and Safety: Detecting Unwanted Location Trackers

As smart trackers became mainstream, standardization around safety has shifted from a nice-to-have feature to a core requirement. The most influential effort is the IETF-led framework known as Detecting Unwanted Location Trackers, jointly promoted by Apple and Google to address stalking and covert surveillance risks.

This initiative establishes a common technical language that allows smartphones to recognize trackers regardless of brand or operating system. According to the IETF draft, a tracker that is separated from its owner must broadcast a specific Bluetooth Low Energy pattern, enabling nearby devices to identify it as a potential risk.

The standard also balances privacy with traceability by requiring rotating identifiers. These identifiers change frequently to prevent mass surveillance, yet remain cryptographically linkable so detection algorithms can still recognize a single physical device over time.

| Requirement | Purpose | User Impact |

|---|---|---|

| BLE identifier patterns | Detect unknown trackers | Automatic safety alerts |

| Identifier rotation | Protect owner privacy | Reduced tracking abuse |

| Forced sound playback | Physical discovery | Easier removal of hidden tags |

Apple and Google engineers have publicly emphasized that sound playback is non-optional. When triggered by a nearby phone, the tracker must emit an audible alert, making silent long-term tracking technically impossible without hardware modification.

From a consumer perspective, this standard changes how trust is evaluated. Safety is no longer defined by the brand of the tracker, but by compliance with a shared protocol shaped by platform vendors and reviewed by the global internet engineering community.

Battery-Free Tracking and the Rise of Energy Harvesting

Battery-free tracking is no longer a speculative concept but an emerging reality that is beginning to reshape how location technology is designed and deployed. Traditional smart trackers rely on coin-cell batteries or rechargeable cells, which inevitably introduce maintenance friction. **Energy harvesting removes this limitation by allowing tags to operate indefinitely, drawing power from their surrounding environment instead of stored electricity.** This shift is particularly meaningful for users who want true set-and-forget tracking.

At the core of this movement is ambient energy harvesting, which captures small amounts of power from light, radio waves, or electromagnetic noise already present in daily life. According to research published through IEEE and university-led collaborations, modern ultra-low-power chips can function with only microwatts of energy, enough to transmit periodic Bluetooth signals. This technical threshold is what makes battery-free tracking feasible rather than theoretical.

Several concrete implementations have demonstrated how this works in practice. At CES 2026, Minew showcased a Bluetooth tracker developed with Epishine that uses organic photovoltaic cells. These cells can generate power even under indoor lighting conditions of a few hundred lux, such as offices or homes. **As long as the object is exposed to light for part of the day, the tracker continues to function without ever needing a battery replacement.**

| Energy Source | Representative Use Case | Key Advantage |

|---|---|---|

| Indoor light (OPV) | Office equipment, wallets | No battery, thin form factor |

| Ambient RF signals | Logistics, apparel tags | Works without light exposure |

| Dedicated RF power | Warehouses, factories | Predictable energy supply |

Another influential player is Wiliot, whose battery-free Bluetooth tags harvest energy from surrounding radio waves such as Wi-Fi and Bluetooth transmissions. These stamp-sized devices are already being piloted in large-scale logistics, where thousands of tags would make battery maintenance economically impossible. Industry analysts often cite Wiliot’s deployments as evidence that **energy harvesting is not just greener, but structurally necessary for massive IoT scale.**

From an environmental perspective, the implications are significant. The elimination of billions of disposable coin batteries directly addresses electronic waste concerns. Academic studies referenced by sustainability researchers at MIT have pointed out that battery-free sensors can reduce lifecycle emissions by double-digit percentages when deployed at scale. This aligns battery-free tracking with broader ESG goals rather than positioning it as a niche gadget feature.

That said, limitations remain. Energy-harvesting trackers typically transmit less frequently and may struggle in environments with minimal light or RF activity. However, ongoing work in ambient backscatter communication, highlighted in recent IEEE surveys, shows rapid improvements in reliability and signal decoding. **The trajectory is clear: as chips become more efficient, battery-free tracking will move from specialized deployments into everyday consumer use.**

Real-World Use Cases: Cars, Pets, and Logistics Transformation

In real-world environments, smart tracking technologies are no longer experimental gadgets but are becoming quietly embedded into daily routines across cars, pets, and logistics. What makes this shift notable is not novelty but reliability. **The value of loss-prevention tags today lies in how they perform under imperfect, real conditions**, such as radio interference, human movement, and fragmented infrastructure.

In the automotive domain, vehicle theft countermeasures illustrate this reality clearly. According to reporting by Japanese technology media and law enforcement briefings, owners of high-risk models such as large SUVs increasingly conceal Bluetooth-based trackers inside vehicle interiors. Unlike conventional GPS units, which are easily neutralized by jamming devices, BLE- and UWB-assisted trackers rely on opportunistic detection by nearby smartphones. This makes complete signal suppression significantly harder in urban environments.

Field interviews cited by automotive security analysts indicate that recovery cases often hinge on short, intermittent location updates rather than continuous tracking. **Even a single successful location ping can narrow a search area from kilometers to meters**, especially when combined with UWB-based precision finding. This layered approach has shifted user behavior from passive insurance reliance to active, technology-assisted risk mitigation.

| Use Case | Primary Technology | Practical Advantage |

|---|---|---|

| Stolen vehicles | BLE + UWB | Resilience against GPS jamming |

| Pet monitoring | UWB proximity sensing | Directional, context-aware access control |

| Logistics assets | Battery-free BLE | Zero maintenance at scale |

Pet monitoring provides another instructive example. While GPS collars dominate marketing narratives, their real-world limitations such as weight, charging frequency, and indoor inaccuracy have become increasingly apparent. At CES 2026, Pawport demonstrated how UWB-based proximity detection enables far more nuanced behavior. Instead of merely detecting presence, the system responds to precise distance thresholds, allowing smart doors to open only when a registered animal approaches within a defined range.

Researchers and industry reviewers have noted that this approach reduces false positives caused by neighboring animals or passing humans. **The outcome is not just convenience but behavioral stability**, as pets learn consistent cause-and-effect interactions with their environment. This represents a subtle but important evolution from tracking location to managing spatial relationships.

In logistics, the transformation is even more structural. Battery-free tracking tags, such as those developed by Wiliot, are now being deployed at pallet and container levels. Academic and industrial studies presented at IEEE-related conferences emphasize that eliminating batteries removes the single largest operational bottleneck: maintenance. When tens of thousands of assets are involved, even minimal servicing becomes economically prohibitive.

By harvesting ambient radio energy, these tags enable continuous identification and condition awareness without human intervention. **Supply chain visibility shifts from periodic audits to ambient awareness**, allowing companies to detect bottlenecks, losses, or temperature deviations in near real time. Analysts from global logistics consultancies have described this as a foundational step toward truly autonomous inventory systems.

Across cars, pets, and logistics, a common pattern emerges. Smart tracking succeeds not by offering perfect visibility, but by integrating gracefully into existing human and industrial networks. The technology works because people, devices, and infrastructure unknowingly participate together, turning everyday motion into a shared sensing fabric.

Legal and Ethical Challenges Shaping the Future of Tracking

As tracking technologies become deeply embedded in everyday life, legal and ethical constraints are no longer peripheral issues but core design requirements. Governments, platform providers, and manufacturers are now forced to respond to a growing tension between convenience and individual rights.

One of the most influential developments is the tightening of regulations around unauthorized tracking. According to legislative analyses cited by major technology policy researchers, laws amended in the mid-2020s increasingly define Bluetooth and UWB trackers as potential surveillance tools, not neutral gadgets. This shift legally reframes misuse from a moral failure into a prosecutable act, fundamentally changing how companies assess risk.

| Challenge | Legal Focus | Ethical Implication |

|---|---|---|

| Unauthorized tracking | Explicit prohibition | Consent as default |

| Data retention | Minimization rules | Right to be forgotten |

| Cross-platform alerts | Interoperability mandates | Collective safety |

From an ethical standpoint, privacy scholars frequently referenced by institutions such as the Electronic Frontier Foundation emphasize proportionality. Tracking a lost backpack is acceptable; silently monitoring a person is not. This distinction has driven the adoption of automatic alerts and audible warnings when a tracker travels with someone other than its owner.

However, these safeguards introduce new dilemmas. Anti-stalking measures can undermine legitimate uses such as theft recovery, raising questions about whose safety should be prioritized. The future of tracking will therefore be shaped not only by technical innovation, but by society’s ability to negotiate trust, accountability, and transparency within the law.

参考文献

- Mordor Intelligence:Smart Tracker Market Report | Industry Analysis, Size & Forecast Overview

- Research and Markets:Smart Tracker Market Report 2025

- TechRadar:New leak hints at Apple AirTag 2 release window – here’s what to expect

- CNET:What Is Google’s Find My Device Network and How to Opt Out of It

- IEEE Xplore:Improving UWB Positioning Accuracy by Fusion With Pedestrian Dead-Reckoning

- IETF:Detecting Unwanted Location Trackers

- Lifehacker:CES 2026: Pawport’s Smart Dog Door Launched With One Big Upgrade