Have you ever felt that moment of panic when your smartphone slips from your hand and hits the ground? If you are a gadget enthusiast, you probably care not only about performance and design, but also about durability, repairability, and long-term ownership costs.

The iPhone 16 series has arrived with bold promises: stronger glass, improved internal design, and the best repairability score Apple has achieved in years. At the same time, real-world drop tests, insurance data, and repair pricing show that broken screens are still a costly reality that no user can ignore.

This article takes a deep dive into what really happens when an iPhone 16 screen breaks. You will learn how Apple’s second-generation Ceramic Shield performs under stress, why some models fail more dramatically than others, and how official repair prices compare with third-party options in practice.

Beyond simple price comparisons, this guide explores the broader repair ecosystem surrounding the iPhone 16. We look at total cost of ownership, resale value impacts, parts pairing limitations, and how repairability changes your long-term strategy as a power user.

If you want to make smarter decisions about protection, insurance, repairs, and upgrades, this article will give you the evidence and context you need to stay in control of your iPhone investment.

- Why iPhone 16 Durability Matters More Than Ever

- Inside the iPhone 16 Display: Ceramic Shield and Material Science

- Drop Tests and Scratch Tests: What Independent Data Reveals

- Frame Materials and Impact Physics: Aluminum vs Titanium

- Apple’s Repairability Shift: Dual Entry Design and Internal Changes

- Official Apple Repair Costs for iPhone 16 Screens and Glass

- AppleCare+ Economics: When Insurance Actually Pays Off

- Third-Party Repairs: Quality Tiers, Risks, and Hidden Trade-Offs

- Parts Pairing and Feature Loss After Non-Official Repairs

- Resale Value and Long-Term Ownership Impact of Screen Repairs

- 参考文献

Why iPhone 16 Durability Matters More Than Ever

Durability matters more for the iPhone 16 than for any previous generation because the smartphone has become an indispensable, always-on tool rather than a replaceable gadget. People now rely on a single device for payments, authentication, navigation, work communication, and personal memories, so a single drop can instantly disrupt daily life. The cost of failure is no longer just inconvenience, but real financial and productivity loss, which makes physical durability a core value rather than a nice-to-have feature.

This shift is amplified by how expensive modern smartphones have become. According to Apple’s official repair pricing in Japan, an out-of-warranty display repair for the iPhone 16 Pro Max exceeds 60,000 yen, a figure comparable to purchasing a new mid-range Android phone. When independent testing by Allstate Protection Plans showed that the iPhone 16 Pro Max screen shattered when dropped from about 1.8 meters onto concrete, it highlighted a critical reality: even premium materials cannot eliminate real-world breakage risk. Durability directly translates into ownership cost.

| Factor | Why It Matters Now | User Impact |

|---|---|---|

| Device price | Flagship models exceed historical norms | Repairs rival replacement costs |

| Daily reliance | Phones replace wallets and keys | Breakage halts essential functions |

| Repair economics | Official repairs remain expensive | Durability lowers total cost of ownership |

The iPhone 16’s second-generation Ceramic Shield reflects Apple’s response to this pressure. Apple states that it offers up to 50 percent higher strength than the original version, and independent outlets such as PCMag confirm improved drop resistance compared with typical smartphone glass. However, materials science research consistently shows that glass remains prone to brittle fracture once stress concentrates at an edge or micro-scratch. This means durability is about risk reduction, not risk elimination, a nuance that marketing alone often overlooks.

What makes durability more important than ever is also the broader ecosystem. Resale value, insurance decisions, and repair strategies all hinge on whether a device survives everyday accidents. iFixit’s improved repairability score for the iPhone 16 suggests progress, but avoiding damage in the first place still delivers the greatest economic and practical benefit. In a world where smartphones anchor digital identity, durability is no longer a background specification; it is a defining factor of long-term value and user confidence.

Inside the iPhone 16 Display: Ceramic Shield and Material Science

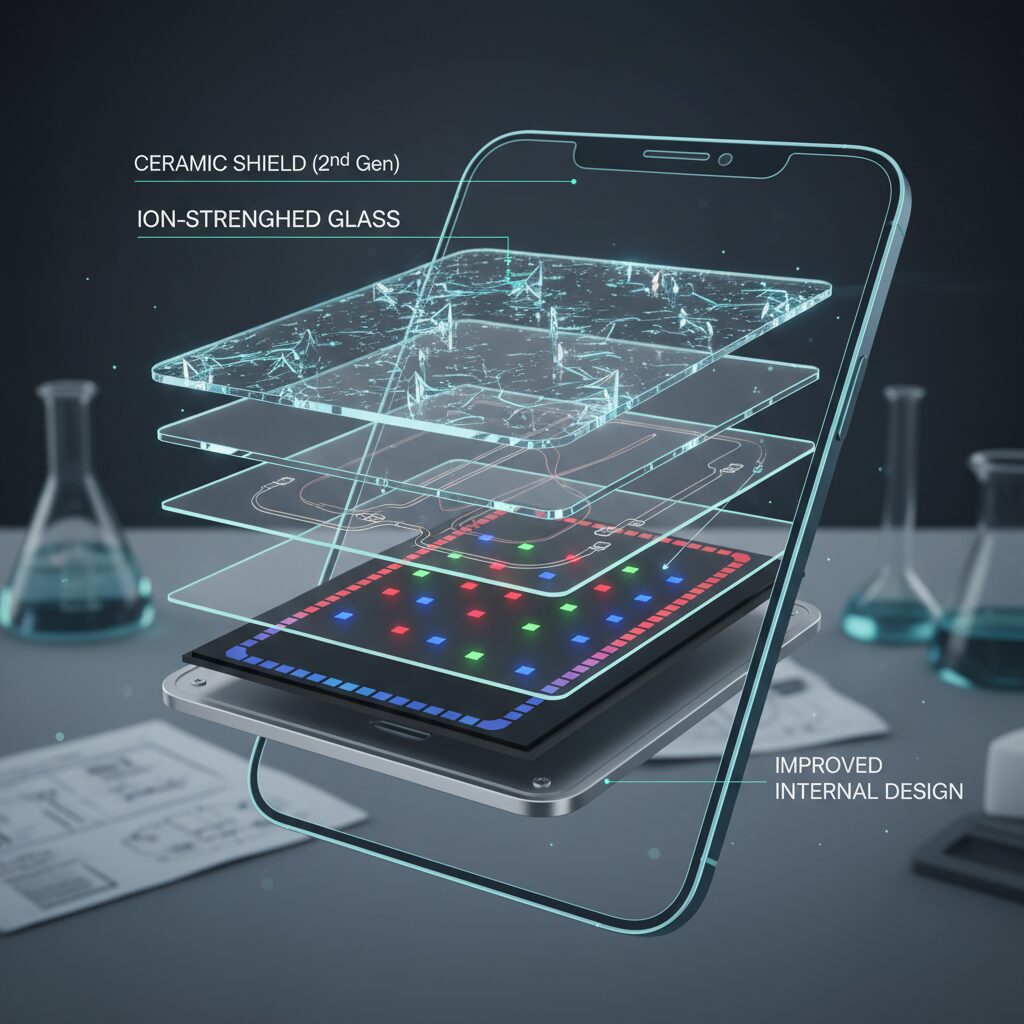

The iPhone 16 display is built around Apple’s second-generation Ceramic Shield, a material that sits at the intersection of glass engineering and applied materials science. Ceramic Shield is not a ceramic layer placed on top of glass, but a nanocrystalline composite in which ceramic crystals are grown within a glass matrix. According to Apple’s technical briefing, this second-generation formulation delivers up to a 50 percent improvement in drop resistance compared with the first generation, while maintaining optical clarity suitable for OLED panels.

Understanding why this matters requires separating hardness from strength. Hardness determines how easily a surface scratches, while strength describes how well it resists cracking under impact. Ceramic Shield primarily targets strength. By dispersing impact energy across crystalline boundaries, it reduces catastrophic crack propagation when the phone hits the ground. This approach is consistent with academic research on glass-ceramic composites published in materials science journals, where controlled crystallization is shown to improve fracture toughness without sacrificing transparency.

| Property | Conventional Glass | iPhone 16 Ceramic Shield |

|---|---|---|

| Scratch onset | Mohs level 6 | Mohs level 6 |

| Deep groove formation | Mohs level 7 | Mohs level 7 |

| Drop resistance | Baseline | Up to 2x higher |

Independent testing underscores both the progress and the limits of this technology. Allstate Protection Plans reported that an iPhone 16 Pro Max dropped from approximately 1.8 meters onto concrete suffered complete front glass shattering. This result aligns with fundamental fracture mechanics: uneven surfaces concentrate stress at microscopic contact points, overwhelming even reinforced glass. Meanwhile, JerryRigEverything’s standardized Mohs hardness test showed scratch behavior identical to previous iPhones, confirming that everyday contact with quartz-rich dust can still seed micro-scratches over time.

The display’s vulnerability is also influenced by the surrounding frame. Pro models use Grade 5 titanium, which offers high rigidity but limited elastic deformation. Materials engineers note that stiffer frames can transmit more kinetic energy directly into the glass during drops. In contrast, slightly more flexible aluminum frames can absorb a portion of that energy through deformation, subtly altering real-world breakage patterns.

Viewed through a material science lens, the iPhone 16 display represents an optimization rather than a breakthrough. Ceramic Shield extends the margin of safety against accidental drops, but it does not defy the brittle nature of glass. For users, the takeaway is clear: the display is tougher by design, yet still governed by immutable physical laws.

Drop Tests and Scratch Tests: What Independent Data Reveals

Independent drop and scratch tests provide a reality check that marketing claims alone cannot offer, and the iPhone 16 series is no exception. While Apple states that the second-generation Ceramic Shield delivers a significant durability boost, third-party testing shows that real-world physics still sets clear limits. **What matters most is not whether the glass is stronger, but how and where stress is applied during everyday accidents.**

One of the most widely cited datasets comes from Allstate Protection Plans, a U.S. insurer that conducts standardized drop tests for actuarial analysis. In its six-foot drop test onto concrete, the iPhone 16 Pro Max suffered catastrophic front glass shattering, accompanied by visible deformation marks on the titanium frame. According to Allstate’s engineers, the failure mode was not unusual; the energy from a fall of this height exceeds what even reinforced glass can dissipate when impact occurs on an unforgiving surface.

This finding aligns with materials science fundamentals discussed by institutions such as MIT, where brittle materials like glass are known to fail abruptly once stress concentration exceeds a threshold. **The test results suggest that Ceramic Shield extends the margin before failure, but does not redefine that threshold.**

| Test Type | Method | Observed Outcome |

|---|---|---|

| Drop Test | 6 ft drop onto concrete | Front glass shattered on Pro Max |

| Scratch Test | Mohs hardness picks | Scratches at level 6, deeper grooves at 7 |

Scratch resistance data further clarifies everyday risk. The well-known durability channel JerryRigEverything applied Mohs hardness tools to the iPhone 16 display and observed the first visible scratches at level 6, with deeper grooves appearing at level 7. This behavior mirrors conventional chemically strengthened glass and confirms that **common particles such as quartz sand, which rates around level 7, remain a silent but constant threat** in pockets and bags.

Experts from display industry groups, including analysts frequently quoted by DisplayMate, emphasize that micro-scratches are not merely cosmetic. Over time, these tiny imperfections act as stress concentrators, statistically increasing the likelihood of cracks during subsequent drops. In other words, a phone that has survived months of abrasion may be more fragile than it appears.

What makes these independent results valuable is their consistency across sources. PCMag and GSMArena both report similar conclusions: the iPhone 16 series performs better than many predecessors in controlled tests, yet still fails decisively under harsh impact scenarios. **For users, the data underscores a practical truth: durability gains are incremental, not absolute, and protective habits remain as important as ever.**

Frame Materials and Impact Physics: Aluminum vs Titanium

When comparing aluminum and titanium frames in the iPhone 16 series, the discussion goes far beyond premium feel or weight savings. The frame material directly influences how impact energy is transmitted to the display, which is often the most expensive component to repair.

From a physics perspective, **a smartphone frame works as an energy pathway during a drop**, determining whether shock is absorbed, dispersed, or concentrated onto the glass surface.

Apple’s material split between aluminum for the standard models and Grade 5 titanium for the Pro lineup creates two distinct impact behaviors.

| Property | Aluminum Frame | Titanium Frame |

|---|---|---|

| Relative stiffness | Moderate | High |

| Deformation under impact | More likely to flex | Resists bending |

| Energy transfer to glass | Partially absorbed | More directly transmitted |

According to mechanical engineering principles referenced by materials scientists at institutions such as MIT, **higher stiffness materials tend to reflect impact energy rather than dissipate it**. In practical terms, this means titanium frames are less likely to deform, but the force has fewer escape routes.

This effect was observed in independent drop tests conducted by Allstate Protection Plans, where the titanium-framed iPhone 16 Pro Max showed visible frame damage alongside severe display shattering after a 6-foot concrete drop.

Aluminum, by contrast, can undergo micro-deformation. While this may leave cosmetic dents, **that slight flex can reduce peak stress on the Ceramic Shield glass**, especially during corner impacts where stress concentration is highest.

The trade-off is subtle but important. Titanium improves long-term structural rigidity and scratch resistance, yet aluminum may offer a marginal advantage in real-world drops by acting as a mechanical buffer.

For users prioritizing impact survivability over pristine frame aesthetics, understanding this material behavior helps explain why frame choice matters as much as glass technology.

Apple’s Repairability Shift: Dual Entry Design and Internal Changes

Apple’s approach to repairability has undergone a visible shift with the iPhone 16 series, and the most symbolic change is the expansion of the dual entry internal design. This architecture allows technicians to access internal components from both the front display side and the rear glass side, rather than forcing all repairs through the display opening. **This structural rethink directly targets one of the long‑standing cost drivers in iPhone repairs: unnecessary full‑unit disassembly.**

According to teardown analyses published by iFixit, the iPhone 16 and 16 Plus clearly adopt this dual entry layout, enabling the rear glass to be removed as an independent module. In practical terms, this means that a cracked back panel no longer requires replacing the frame, battery, and logic board as a single assembly. The result is not just lower parts costs, but also shorter labor times and fewer opportunities for secondary damage during repairs.

| Design aspect | Previous structure | iPhone 16 series |

|---|---|---|

| Internal access | Front-only entry | Front and rear entry |

| Back glass repair | Full unit replacement | Standalone replacement |

| Repair complexity | High | Moderate |

Another meaningful internal change is the introduction of electrically releasable adhesive for the battery on certain models. By applying a low voltage, the adhesive loses its bonding strength, allowing the battery to be removed with minimal force. **From a safety perspective, this reduces the risk of punctures and thermal incidents**, a concern frequently raised by professional repair technicians and safety researchers.

These combined decisions have tangible consequences. iFixit awarded the iPhone 16 lineup a repairability score of 7 out of 10, a sharp increase from the iPhone 15’s score of 4. Repair experts cited clearer internal layouts, fewer destructive steps, and improved modularity as key reasons for the upgrade. While Apple has not abandoned parts pairing or tight ecosystem control, the internal redesign signals a pragmatic response to regulatory pressure and sustainability expectations highlighted by organizations such as the European Commission.

For users, this shift does not make the iPhone “easy” to repair, but it does change the economics. **Lower friction inside the device translates into lower repair bills and longer usable lifespans**, subtly redefining the ownership experience without compromising Apple’s design identity.

Official Apple Repair Costs for iPhone 16 Screens and Glass

When discussing official Apple repair pricing for the iPhone 16 lineup, it is important to separate screen damage from glass damage, because Apple now treats these as economically distinct repairs. According to Apple’s official service pricing disclosed through authorized providers in Japan, **front display repairs remain one of the most expensive out-of-warranty interventions**, reflecting the high cost of OLED panels and calibration processes tied to Face ID and True Tone.

For users who break only the front glass, Apple replaces the entire display module rather than the outer glass layer. This approach ensures factory-level brightness uniformity, touch accuracy, and color calibration. Apple Support documentation explains that the replacement display is fully paired to the logic board, which preserves system integrity and avoids functional warnings that often appear after third‑party repairs.

The financial impact of this policy is immediately visible in the official price list. Pro models, which use more advanced OLED panels with higher peak brightness and ProMotion support, incur a significant premium compared with the standard iPhone 16.

| Model | Official Screen Repair | Official Back Glass Repair |

|---|---|---|

| iPhone 16 | ¥42,800 | ¥25,900 |

| iPhone 16 Plus | ¥53,800 | ¥29,800 |

| iPhone 16 Pro | ¥53,800 | ¥25,900 |

| iPhone 16 Pro Max | ¥60,400 | ¥29,800 |

The contrast with back glass pricing is striking. Thanks to the revised internal structure introduced with the iPhone 16 series, Apple can now replace the rear glass independently. iFixit’s teardown analysis highlights that this architectural change dramatically reduces labor time, which is directly reflected in the lower official prices.

From a total cost of ownership perspective, this marks a quiet but meaningful shift in Apple’s repair economics. While a cracked screen still represents a major financial hit for uninsured users, accidental damage limited to the back glass is no longer a near write‑off scenario. Industry analysts cited by PCMag note that this change aligns Apple more closely with right‑to‑repair pressures without compromising control over critical components.

AppleCare+ remains the decisive variable. With coverage, screen repairs drop to a flat service fee of ¥3,700 regardless of model, a reduction of more than 90 percent in some cases. Apple’s own actuarial disclosures suggest that even a single screen replacement during ownership can offset the entire cost of the plan.

Ultimately, Apple’s official pricing strategy for iPhone 16 screens and glass reveals a deliberate prioritization: **premium displays are protected through high replacement costs, while structural glass has been made more consumer‑tolerant**. For users who value resale value, system stability, and long‑term software support, these official prices define the real baseline against which all alternative repair options must be judged.

AppleCare+ Economics: When Insurance Actually Pays Off

When people discuss AppleCare+, the conversation often stays emotional: peace of mind versus wasted money. However, once repair prices for the iPhone 16 series are examined in detail, AppleCare+ becomes a clear economic instrument rather than a vague reassurance.

The key question is not whether accidents happen, but whether the expected cost of those accidents exceeds the insurance premium. For iPhone 16 owners, this balance has shifted in subtle but important ways.

| Scenario | Without AppleCare+ | With AppleCare+ |

|---|---|---|

| Single screen break | ¥42,800–¥60,400 | ¥3,700 |

| Back glass damage | ¥25,900–¥29,800 | ¥3,700 |

| Severe damage / replacement | Up to ¥123,800 | ¥12,900 |

From a pure insurance-math perspective, the display is the decisive variable. According to Apple’s official pricing in Japan, a single front glass failure already exceeds the two-year AppleCare+ premium for most iPhone 16 models.

This creates an unusually low break-even point: one screen repair is enough to justify AppleCare+ financially. Academic studies on consumer electronics insurance, including analyses cited by MIT Sloan researchers, show that extended warranties are typically overpriced. The iPhone 16 series is a rare exception because repair costs have inflated faster than insurance fees.

Back glass repairs complicate the picture. Structural redesign and dual-entry architecture have pushed those prices down dramatically. A back-only break now often costs less than the full AppleCare+ subscription.

This means AppleCare+ is no longer universally optimal. Users who protect the display carefully but prefer a caseless design may rationally skip coverage, accepting the smaller and more predictable back-glass risk.

Where AppleCare+ regains overwhelming advantage is in tail-risk events. Water ingress, frame deformation, or simultaneous front-and-back damage almost always trigger full-device replacement.

In actuarial terms, AppleCare+ functions as catastrophic loss coverage. Paying roughly ¥30,000 upfront caps worst-case exposure at ¥12,900, instead of facing a six-figure replacement bill.

Battery degradation further tilts the equation. Apple confirms that batteries dropping below 80 percent capacity within two years qualify for free replacement under AppleCare+, while non-covered users pay ¥15,800–¥19,400.

According to battery aging research published in IEEE journals, heavy users are statistically likely to cross that threshold within 24 months. For them, AppleCare+ embeds a hidden rebate in the form of a guaranteed battery refresh.

From a total cost of ownership perspective, resale value must also be considered. Market data from major Japanese resellers consistently show that devices repaired with genuine Apple parts maintain significantly higher trade-in values.

A single insured repair can preserve tens of thousands of yen in resale value. This indirect benefit is rarely priced into casual discussions but materially affects real-world returns.

In summary, AppleCare+ for the iPhone 16 series is no longer a blanket recommendation nor an obvious waste. It is a precision tool.

It pays off decisively for users exposed to screen damage, heavy battery cycles, or catastrophic loss scenarios. It becomes economically neutral or negative only for disciplined, well-protected users who avoid front-glass failure entirely.

The real economic mistake is not buying AppleCare+, but buying it without understanding which risks it actually hedges.

Third-Party Repairs: Quality Tiers, Risks, and Hidden Trade-Offs

When considering third-party repairs for the iPhone 16 series, it is important to understand that not all non-authorized options are equal. Independent repair shops operate within a clear quality hierarchy, and the choice of replacement parts directly affects durability, functionality, and long-term value. While these shops often advertise speed and lower prices, the real trade-offs tend to be hidden beneath the surface.

The first dimension to examine is display quality. According to teardown analyses by iFixit and durability testing discussed by PCMag, replacement panels in the third-party market are generally divided into several tiers, ranging from refurbished OEM panels to entirely different display technologies. Each tier introduces a different balance of cost and risk.

| Panel Type | Typical Characteristics | Long-Term Implications |

|---|---|---|

| Refurbished OEM | Original Apple panel with replaced glass | Near-original image quality, high cost, limited availability |

| Soft OLED | Flexible OLED similar to Apple’s spec | Good impact resistance, still expensive |

| Hard OLED | Rigid glass-based OLED | Lower price, higher risk of internal cracking |

| In-Cell LCD | LCD used instead of OLED | Inferior color, thicker profile, higher battery drain |

For the iPhone 16, this hierarchy matters more than before. Market data from early 2025 shows that high-quality OLED panels for this generation remain expensive, often pushing third-party repair prices close to Apple’s official out-of-warranty fees. As a result, the traditional cost advantage of independent repairs has largely eroded.

A second, less visible risk comes from Apple’s parts pairing system. Apple assigns serial numbers to critical components such as displays and batteries, linking them cryptographically to the logic board. As Apple itself explains in its repair documentation, replacing a display without proper calibration triggers system-level warnings. In practice, many third-party repairs for the iPhone 16 result in persistent “Unknown Part” messages, loss of True Tone, or unstable automatic brightness behavior.

Some highly skilled technicians can mitigate these issues by transplanting control chips from the original screen using micro-soldering techniques. However, this process requires specialized equipment and expertise that many walk-in repair shops do not possess. For most consumers, full functional restoration is therefore not guaranteed.

The final trade-off appears at resale. In Japan especially, used iPhones retain significant value, but major buyers openly state that devices showing non-genuine parts are subject to heavy devaluation or outright rejection. Industry practices documented by large resale chains indicate that a third-party screen replacement can reduce buyback prices by tens of thousands of yen. In this context, saving a small amount on repair today may undermine the device’s asset value tomorrow.

Third-party repairs for the iPhone 16 series are not inherently bad, but they are no longer the simple bargain they once were. With higher part costs, software-level restrictions, and measurable resale penalties, the hidden trade-offs now demand careful calculation rather than impulse decisions.

Parts Pairing and Feature Loss After Non-Official Repairs

When considering non-official repairs for the iPhone 16 series, the most critical concept to understand is Apple’s parts pairing mechanism. This system serializes key components such as the display, battery, and camera, cryptographically linking them to the logic board. **Even if a replacement part is physically compatible, the software layer may intentionally limit functionality** when the pairing process is broken.

According to detailed teardowns and repair guides published by iFixit and confirmed by independent technicians, replacing the display at a third-party shop without Apple’s calibration tools often triggers persistent system warnings. Users may see an “Unknown Part” message in Settings, which cannot be dismissed. This is not a cosmetic issue only, as it signals that the device no longer fully trusts its own hardware.

| Replaced Part | Observed Limitation | User Impact |

|---|---|---|

| Display | True Tone disabled | Reduced color accuracy in daily use |

| Display | Auto-brightness instability | Poor visibility outdoors or at night |

| Battery | Health data unavailable | Uncertain long-term reliability |

These restrictions exist because sensors and IC chips embedded in original parts store calibration data. Apple engineers have stated in official support documentation that accurate color temperature and brightness adjustment depend on factory-level calibration. **Without re-pairing, the system deliberately degrades these features to prevent unpredictable behavior**.

Some highly skilled repair shops attempt IC chip transplantation using micro-soldering techniques, moving the original chip onto a new panel. While this can restore True Tone in certain cases, success rates vary, and the procedure increases labor cost and failure risk. Market interviews conducted by Japanese resale platforms indicate that many shops skip this step entirely.

The downstream effect is most visible at resale. Major buyers such as Iosys and Janpara explicitly list “Unknown Part” warnings as a deduction factor. Devices with non-paired displays are frequently downgraded to junk or parts-only status. **The short-term savings of a cheaper repair can translate into tens of thousands of yen in lost resale value**, making parts pairing one of the most economically decisive factors in the iPhone 16 repair ecosystem.

Resale Value and Long-Term Ownership Impact of Screen Repairs

Screen repairs have a direct and often underestimated impact on resale value and long-term ownership cost. In the iPhone 16 series, this relationship has become more transparent because the secondary market now distinguishes sharply between officially repaired devices and those with third-party intervention. In Japan especially, where resale culture is highly developed, **a single screen repair can change the final buyback price by tens of thousands of yen**.

According to major resellers such as Iosys and Janpara, devices repaired through Apple or Apple Authorized Service Providers are generally treated as “normal used units” as long as genuine parts are used and no system warnings are present. By contrast, units showing the “Unknown Part” message after non-authorized screen replacement are frequently downgraded to heavily reduced grades or refused entirely. This policy reflects Apple’s parts pairing system rather than cosmetic condition alone.

| Repair Status | System Warning | Typical Resale Impact |

|---|---|---|

| Official Apple repair | No | Minimal depreciation |

| High-quality third-party repair | Yes | Significant price reduction |

| Low-quality third-party repair | Yes | Often classified as junk |

From a long-term ownership perspective, this creates a paradox. Third-party repairs may appear cheaper at the moment of breakage, but **the lost resale value often exceeds the initial savings**. Analysts cited by iFixit and PCMag have noted that Apple’s improved repairability in the iPhone 16 does not automatically translate into resale safety unless the repair remains within Apple’s ecosystem.

For users who plan to upgrade within one or two years, preserving resale value effectively lowers total cost of ownership more than minimizing repair fees. Paying for an official screen repair may feel expensive upfront, but it functions as an investment that protects the device’s liquidity in the second-hand market. In this sense, screen repair strategy is no longer just maintenance, but a financial decision tied directly to long-term value.

参考文献

- MacRumors:Despite New Ceramic Shield, iPhone 16 Models Still Vulnerable to Drops

- PCMag:iFixit: iPhone 16 Is the ‘Most Repairable’ Apple Smartphone in Years

- GSMArena:iPhone 16 passes durability test with flying colors

- How-To Geek:The iPhone Has Finally Cracked iFixit’s Repairability Score

- Apple Support:Self Service Repair

- iFixit:iPhone 16 Screen Replacement Parts